Japan Surgical Robots Market Trends, Size Analysis, and Forecast 2025–2033

Japan Surgical Robots Market Size and Forecast 2025–2033

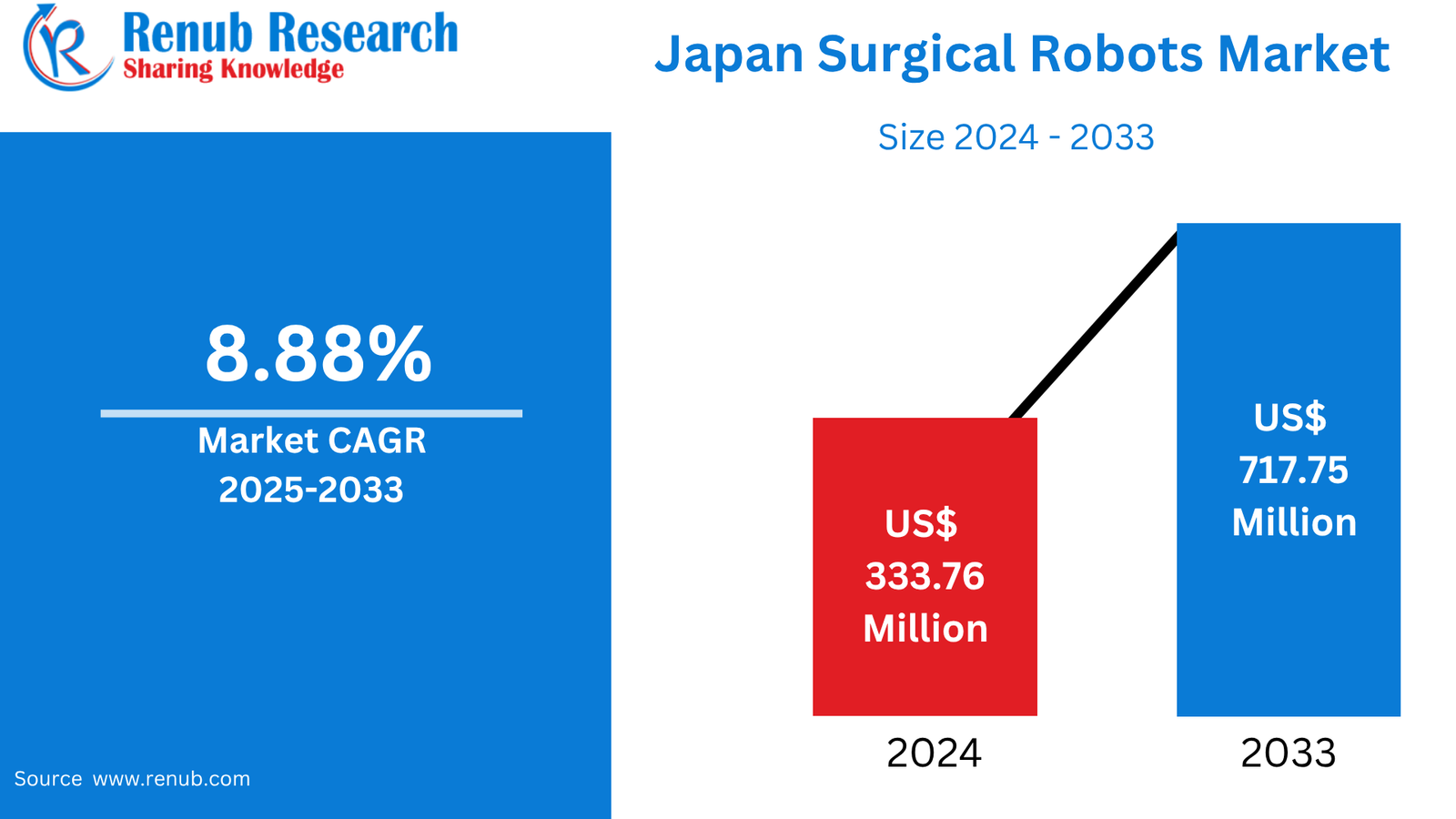

According To Renub Research Japan surgical robots market is positioned for steady and technology-driven growth over the forecast period. Valued at US$ 333.76 million in 2024, the market is expected to reach US$ 717.75 million by 2033, expanding at a compound annual growth rate (CAGR) of 8.88% from 2025 to 2033. This growth trajectory is primarily supported by the increasing preference for minimally invasive (MI) surgical procedures among both patients and healthcare professionals. Japan’s advanced healthcare system, combined with a rapidly aging population and continuous investments in medical robotics, has created a favorable environment for the adoption of robotic-assisted surgical technologies across multiple medical specialties.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=japan-surgical-robots-market-p.php

Japan Surgical Robots Industry Overview

Surgical robots are computer-controlled medical devices designed to assist surgeons in performing laparoscopic and minimally invasive procedures with enhanced precision and control. These systems typically include robotic arms equipped with miniature surgical instruments and a high-definition three-dimensional camera that provides surgeons with a magnified and accurate view of the surgical field. By replicating and refining human hand movements, surgical robots enable complex procedures to be carried out through very small incisions.

Compared with conventional open surgeries, robotic-assisted procedures offer numerous benefits, including reduced blood loss, lower risk of infection, minimal scarring, and faster recovery times. Advanced features such as motion sensors, data recording systems, high-definition microscopic cameras, robot-controlled catheters, and 3D imaging systems significantly enhance surgical accuracy and consistency. In Japan, these systems are increasingly being integrated into hospital workflows, particularly for procedures that demand extreme precision, such as neurosurgery, urology, and cardiovascular interventions.

Market Dynamics and Growth Environment in Japan

The Japanese surgical robots market is expanding rapidly due to a combination of demographic, clinical, and technological factors. One of the most significant drivers is the country’s aging population, which has led to a higher prevalence of chronic and degenerative diseases requiring surgical intervention. Older patients often benefit more from minimally invasive approaches, as these procedures reduce physical stress and post-operative complications.

In addition, healthcare providers in Japan are actively adopting robotic systems to improve surgical outcomes, operational efficiency, and patient satisfaction. The rising incidence of neurological disorders has further contributed to the demand for neurosurgical robots, which enhance accuracy in delicate procedures such as needle placement and retraction near sensitive neural structures. Continuous improvements in healthcare infrastructure and increasing public and private investments in medical technology research and development are also accelerating market growth.

Population Aging and Rising Surgical Demand

Japan has one of the world’s oldest populations, with nearly one-third of its citizens aged 65 and above. This demographic shift has resulted in a growing number of age-related conditions such as cardiovascular disease, orthopedic disorders, cancer, and neurological illnesses. As a result, the demand for complex surgical procedures has increased substantially across the country.

Surgical robots play a crucial role in addressing the healthcare needs of elderly patients. Robotic-assisted surgeries minimize surgical trauma, shorten hospital stays, and support quicker rehabilitation, which is especially important for older individuals with limited recovery capacity. By reducing complications and improving precision, these systems help hospitals deliver safer and more effective care. Consequently, population aging remains one of the strongest long-term drivers of the surgical robots market in Japan.

Advancements in Robotics and Digital Technologies

Rapid technological advancements have significantly improved the functionality and versatility of surgical robots. Modern systems are equipped with enhanced imaging technologies that provide real-time, high-definition 3D visualization, allowing surgeons to operate with exceptional clarity. Robotic arms now offer greater flexibility and dexterity than the human hand, enabling precise movements in confined anatomical spaces.

The integration of artificial intelligence (AI) has further transformed robotic surgery by supporting surgical planning, reducing error margins, and enabling adaptive learning during procedures. In addition, the use of data analytics, the Internet of Things (IoT), and virtual and augmented reality (VR/AR) technologies has enhanced preoperative planning and surgeon training. These advancements are making robotic surgery more efficient, reliable, and accessible, thereby accelerating adoption across Japanese healthcare institutions.

Government Support and Strategic Investments

The Japanese government plays a critical role in promoting the adoption of surgical robots through supportive policies and targeted investments. National initiatives focused on advancing future medical technologies encourage hospitals and research institutions to integrate robotics into clinical practice. Public funding and subsidies help offset the high initial costs of robotic systems, making them more accessible to healthcare providers.

In addition, government-backed training programs aim to upskill surgeons and medical staff in robotic-assisted procedures, ensuring safe and effective use of these advanced systems. Efforts to expand access beyond major metropolitan areas are also underway, supporting regional hospitals in adopting robotic technologies. This proactive governmental approach strengthens Japan’s position as a global leader in medical robotics and contributes significantly to market expansion.

High Cost and Affordability Constraints

Despite strong growth potential, the Japan surgical robots market faces challenges related to cost and affordability. Surgical robotic systems require substantial capital investment, including the purchase of hardware and software, installation, maintenance, and regular upgrades. These costs can be prohibitive for smaller hospitals and clinics, particularly those operating in rural or regional areas.

In addition to equipment expenses, healthcare providers must invest in training surgeons and support staff, further increasing the overall financial burden. While large urban hospitals are better positioned to absorb these costs, smaller institutions often struggle to justify the investment. This cost disparity limits widespread adoption and results in uneven access to advanced robotic surgical care across the country.

Limited Awareness and Training Among Surgeons

Another key challenge in the Japanese surgical robots market is the limited availability of specialized training and hands-on experience for surgeons. Robotic-assisted surgery requires skills that differ significantly from traditional surgical techniques, and many practitioners remain hesitant to adopt these systems due to unfamiliarity.

Hospitals often face difficulties in allocating time and resources for comprehensive training programs, particularly given heavy clinical workloads. Without adequate training, surgeons may be reluctant to fully utilize robotic systems, potentially affecting surgical outcomes. Expanding simulation-based training, fostering partnerships between hospitals and academic institutions, and collaborating with device manufacturers are essential steps to overcoming this barrier and encouraging broader market adoption.

Regional Concentration of Market Growth

The adoption of surgical robots in Japan is heavily concentrated in major metropolitan regions where healthcare infrastructure, funding, and expertise are more readily available. Cities such as Tokyo, Osaka, and Nagoya serve as key hubs for robotic surgery, while rural regions experience slower adoption due to cost and training limitations. Regional disparities remain a challenge, although ongoing policy efforts aim to improve nationwide access.

Tokyo Surgical Robots Market

Tokyo represents the largest and most advanced surgical robots market in Japan. As the country’s primary medical and research center, the city hosts numerous state-of-the-art hospitals that actively invest in robotic surgical technologies. High patient volumes, strong demand for minimally invasive procedures, and significant government and private-sector investments drive rapid adoption.

Tokyo also benefits from extensive training programs and research collaborations, which help address skill gaps among surgeons. As a result, the city often sets trends in robotic surgery that gradually influence other regions. However, high infrastructure and operational costs continue to pose challenges for some healthcare institutions.

Kansai Surgical Robots Market

The Kansai region, including Osaka, Kyoto, and Kobe, plays a vital role in Japan’s surgical robotics landscape. Osaka has emerged as a major center for advanced medical technologies, with several hospitals integrating robotic systems to enhance surgical precision and efficiency. The region benefits from strong academic and clinical partnerships that support innovation and adoption.

Kansai is also notable for the development of domestically produced robotic systems, which has strengthened local capabilities and reduced reliance on imported technologies. This regional innovation ecosystem positions Kansai as a key contributor to the national growth of robotic-assisted surgery.

Aichi Surgical Robots Market

Aichi Prefecture, with Nagoya as its capital, is another important region in the Japanese surgical robots market. The area’s strong industrial base and advanced healthcare infrastructure support the adoption of cutting-edge medical technologies. The presence of major manufacturing and engineering expertise creates a favorable environment for innovation and collaboration in medical robotics.

Hospitals in Aichi are increasingly adopting robotic systems as demand for minimally invasive procedures rises. Improved affordability and domestic production options further enhance the region’s growth potential, positioning Aichi as a significant contributor to future market expansion.

Market Segmentation by Component

By component, the Japan surgical robots market is segmented into surgical systems, accessories, and services. Surgical systems account for the largest share due to their high cost and central role in robotic-assisted procedures. Accessories, including specialized instruments and consumables, generate recurring demand, while services such as maintenance, training, and software updates support long-term system performance.

Market Segmentation by Area of Surgery

Based on area of surgery, the market includes gynecological surgery, cardiovascular procedures, neurosurgery, orthopedic surgery, laparoscopy, urology, and other specialized applications. Urology and gynecology remain leading segments due to high procedural volumes and proven clinical benefits, while neurosurgery and cardiovascular applications are expanding rapidly with technological advancements.

Market Segmentation by Cities

The market is analyzed across major cities including Tokyo, Kansai, Aichi, Kanagawa, Saitama, Hyogo, Chiba, Hokkaido, Fukuoka, and Shizuoka. Urban centers dominate adoption due to better infrastructure and funding, while secondary cities represent untapped growth opportunities.

Competitive Landscape and Company Analysis

The Japan surgical robots market is characterized by the presence of leading global and regional players competing on technology, innovation, and clinical performance. Key companies operating in the market include Intuitive Surgical Inc., Stryker Corporation, Johnson & Johnson, Renishaw PLC, Accuray Incorporated, Titan Medical Inc., Medtronic PLC, Smith & Nephew PLC, and Zimmer Biomet.

These companies focus on product innovation, strategic partnerships, training initiatives, and regional expansion to strengthen their market presence. Continuous advancements in robotic platforms and growing clinical acceptance are expected to intensify competition while driving overall market growth through 2033.