Australia Pork Meat Market: Growth, Trends, and Outlook 2030 Report

Australia Pork Meat Market Overview

According To Renub Research Australia pork meat market represents a steadily expanding segment of the national meat industry, supported by evolving dietary habits, strong domestic production standards, and growing demand across both household and commercial applications. Pork is widely consumed due to its flavor versatility, nutritional profile, and suitability for fresh as well as processed food products. Between 2025 and 2033, the market is expected to grow at a moderate yet consistent pace, reflecting stable consumer demand and ongoing innovation across the value chain.

Australia’s pork sector benefits from advanced farming practices, strict biosecurity regulations, and high food safety compliance, making locally produced pork a trusted protein choice. Increasing urbanization, multicultural influences, and expansion of modern retail formats further strengthen the market’s long-term outlook.

Market Size and Forecast 2025–2033

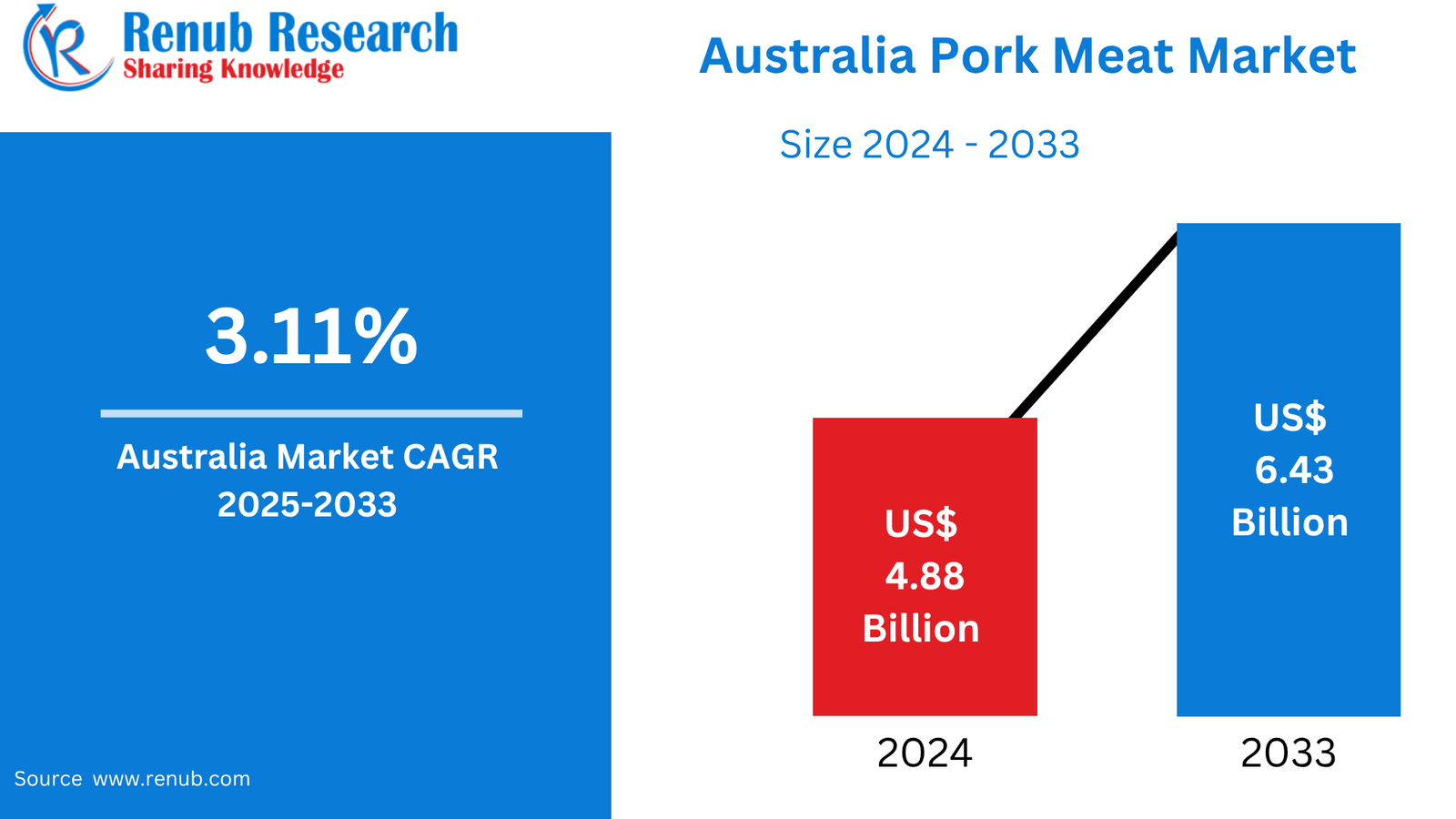

The Australia pork meat market is projected to expand from US$ 4.88 billion in 2024 to approximately US$ 6.43 billion by 2033. This growth corresponds to a compound annual growth rate of around 3.11% during the forecast period. The market’s expansion is driven by rising protein consumption, steady population growth, and continuous product innovation within chilled, frozen, and value-added pork categories.

Stable domestic consumption, combined with increasing foodservice demand, ensures consistent market performance even amid price sensitivity and import competition. The forecast period reflects a balanced growth trajectory rather than rapid expansion, highlighting the maturity and resilience of the Australian pork industry.

Role of Pork in the Australian Food Industry

Pork occupies a vital role in Australia’s diverse food culture. It is consumed in various forms, including fresh cuts such as loin, belly, shoulder, and leg, as well as processed products like bacon, ham, sausages, and cured meats. The adaptability of pork across cuisines has made it a staple ingredient in everyday meals and premium dining alike.

Nutritionally, pork is recognized as a high-quality protein source rich in essential amino acids, B-complex vitamins, particularly thiamine, and important minerals such as zinc and iron. These attributes support its positioning as a balanced protein option suitable for a wide range of consumers.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=australia-pork-meat-market-p.php

Growth Drivers in the Australia Pork Meat Market

Rising Preference for High-Protein Diets

Australian consumers are increasingly prioritizing protein-rich diets to support fitness, weight management, and overall health. Pork’s lean cuts and favorable nutrient composition align well with these dietary preferences. As awareness of balanced nutrition increases, pork is gaining recognition as an alternative to traditional red meats and poultry.

This shift is particularly evident among younger demographics and urban consumers who actively seek variety in protein intake. Government-backed dietary guidelines that promote protein diversity further reinforce pork’s inclusion in everyday diets.

Influence of Multicultural Cuisine

Australia’s multicultural population plays a significant role in shaping pork consumption trends. Asian and European cuisines, where pork is a central ingredient, are deeply integrated into Australian households and foodservice menus. This cultural diversity has expanded demand for specialty cuts, authentic preparations, and region-specific pork products.

Restaurants, supermarkets, and specialty retailers increasingly cater to ethnic preferences, creating new consumption occasions and broadening the appeal of pork across different consumer groups.

Expansion of Processed and Value-Added Products

Convenience-oriented lifestyles have accelerated demand for processed and value-added pork products. Ready-to-cook, pre-marinated, smoked, and cured pork items offer time-saving solutions without compromising taste. Packaging innovations, improved cold-chain infrastructure, and extended shelf-life technologies further support growth in this segment.

Product differentiation through flavor innovation and portion-controlled packaging has enhanced pork’s competitiveness in both retail and foodservice channels.

Challenges Facing the Australia Pork Meat Market

Import Competition and Pricing Pressure

Despite strong domestic production, imported pork—particularly frozen varieties—continues to exert competitive pressure on the local market. Lower-priced imports appeal to cost-conscious consumers and foodservice operators, impacting the profitability of Australian producers.

Volatility in feed prices, energy costs, and global trade dynamics also affects pricing stability, requiring producers to balance quality, cost efficiency, and market competitiveness.

Environmental and Animal Welfare Concerns

Sustainability and ethical farming practices are increasingly influencing purchasing decisions. Consumers and retailers demand transparency around animal welfare, environmental impact, and carbon emissions associated with pork production.

Meeting these expectations often requires significant investment in infrastructure, certification, and reporting systems. While these measures enhance long-term credibility, they also present cost and operational challenges for producers and processors.

Australia Chilled Pork Meat Market

Chilled pork remains the preferred choice for many Australian consumers due to its freshness, flavor, and suitability for immediate cooking. Supermarkets, butcher shops, and specialty meat retailers offer a wide range of chilled pork cuts tailored to everyday meals and special occasions.

Advancements in refrigeration, packaging, and logistics have strengthened the chilled pork supply chain, ensuring food safety and consistent quality. As consumers continue to favor fresh products, the chilled segment maintains a dominant share within the overall pork market.

Australia Frozen Pork Meat Market

Frozen pork plays a crucial role in extending product availability and reducing food waste. It is widely used in processed food manufacturing, foodservice operations, and regional markets where supply consistency is essential.

Technological improvements in freezing and thawing methods have minimized quality degradation, making frozen pork a reliable alternative to fresh options. Competitive pricing and long shelf life continue to support demand in this segment.

Australia Household Pork Meat Market

Household consumption forms the backbone of pork demand in Australia. Pork is commonly prepared through roasting, grilling, stir-frying, and barbecuing, making it suitable for both traditional and modern recipes.

Increased exposure to cooking shows, digital recipes, and social media food content has inspired consumers to experiment with pork-based dishes at home. Easy availability through supermarkets and local butchers further supports steady household demand.

Australia Commercial Pork Meat Market

The commercial segment includes restaurants, hotels, catering services, and institutional buyers. Pork is widely used in quick-service restaurants, casual dining, and premium establishments due to its versatility and cost efficiency.

Growth in tourism, urban dining culture, and food delivery platforms has strengthened demand from the commercial sector. Consistent supply and standardized cuts are critical factors for this segment’s continued expansion.

Distribution Channel Analysis

Supermarkets and hypermarkets dominate pork distribution in Australia, offering convenience, competitive pricing, and a broad product range. Specialty stores focus on premium, organic, and ethically produced pork, appealing to quality-conscious consumers.

Online channels are experiencing rapid growth as digital adoption increases. Consumers value the convenience of home delivery, subscription models, and transparent product information. Other channels, including wholesalers and foodservice distributors, support bulk purchasing and commercial supply needs.

State-Level Market Analysis

New South Wales represents one of the largest pork consumption markets, driven by population density and cultural diversity. Victoria follows closely, supported by a strong food culture and well-developed supply chains.

South Australia contributes through regional production and processing, while Tasmania emphasizes high-quality, small-scale, and ethically produced pork. Other states and territories collectively add to national demand through local consumption and inter-state trade.

Competitive Landscape and Key Players

The Australia pork meat market features a mix of domestic producers and global meat corporations. Leading companies focus on scale, efficiency, and brand strength to maintain market presence. Major players include JBS S.A, Tyson Foods, Pilgrim's Pride Corporation, Danish Crown Group, Vion Food Group, WH Group, Hormel Foods Corporation, and Muyuan Foods.

These companies compete through product quality, supply reliability, innovation, and strategic partnerships. SWOT analysis, revenue performance, leadership strategies, and recent developments shape their competitive positioning within the Australian market.

Market Segmentation Overview

The market is segmented by product type into chilled and frozen pork. By application, it includes household and commercial consumption. Distribution channels cover supermarkets and hypermarkets, specialty stores, online platforms, and others.

Geographically, the market spans all Australian states and territories, reflecting diverse consumption patterns and regional production strengths.

Future Outlook

The Australia pork meat market is expected to maintain steady growth through 2033, supported by consistent consumer demand, product innovation, and evolving distribution models. While challenges related to imports, sustainability, and pricing persist, the industry’s strong regulatory framework and commitment to quality position it well for long-term stability.

As consumer preferences continue to evolve, opportunities will emerge in premium, value-added, and ethically produced pork segments, reinforcing pork’s role as a core protein source in Australia’s food landscape.